Take your financial plans or goals to new heights!

With sound financial planning right at your Credit Union.

Whether you’re looking for overall financial guidance, assistance with a specific financial goal, creating a comprehensive financial plan or just getting a second opinion, we’re here to help.

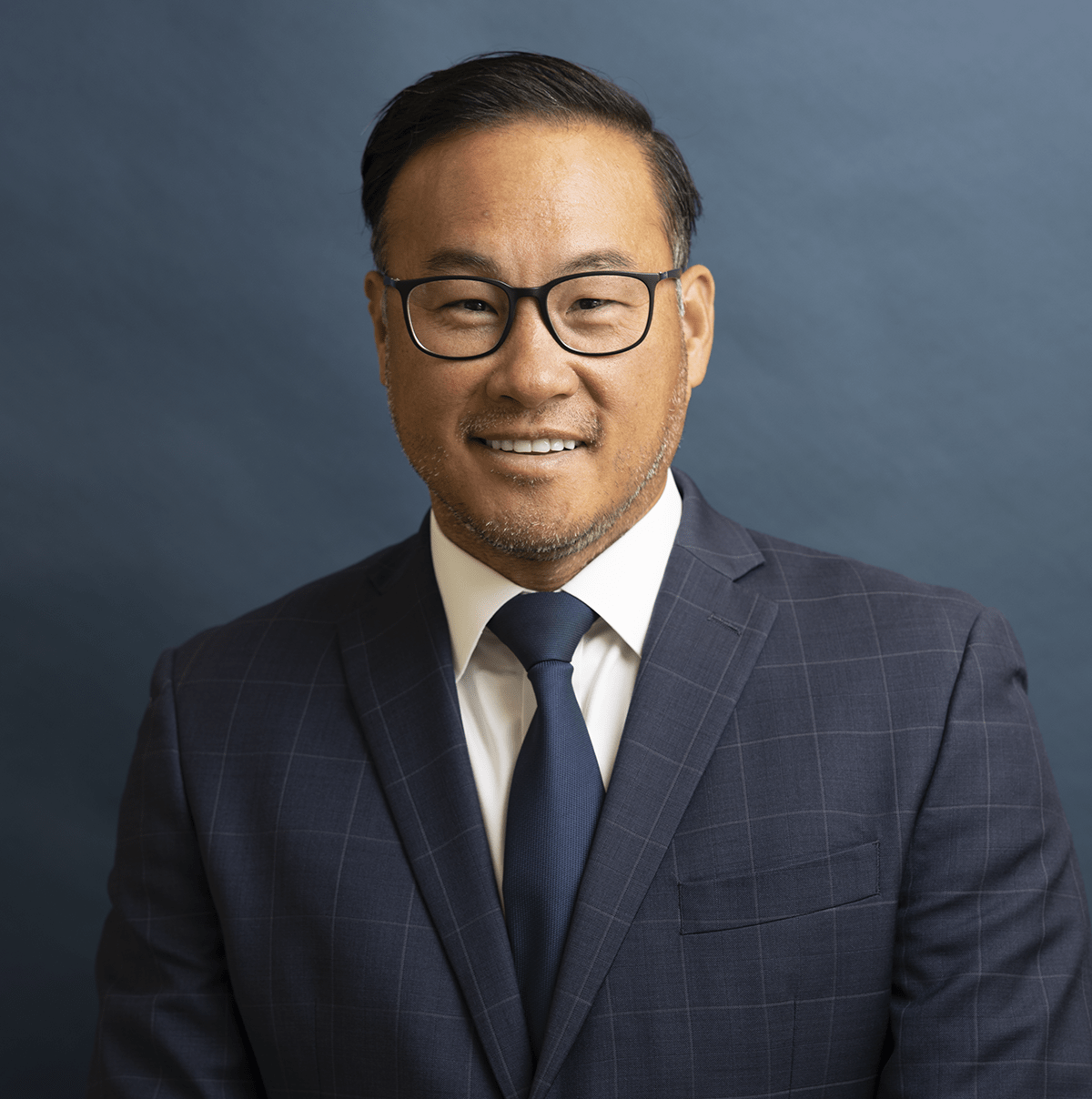

Our LPL Financial Advisors can provide you individualized service, and is experienced in working directly with members like you.

To get started designing your plan, contact us today to schedule a complimentary, no-obligation appointment:

Our Planning Process

Our LPL Financial Advisors will help you build a plan that meets all your financial goals. We understand that not everyone has the same goals in mind. We have a unique planning process to creating a financial plan that will help make your goals a reality!

1. Establish Relationship

Getting to know you. What is important to you?

2. Discovery

Snapshot of your current assets. Identify your current goals and concerns.

3. Design

Develop your personalized financial plan.

4. Implement

With your approval we will implement your plan and handle all of the paperwork.

5. Review

Monitor your financial plan on a regular basis.