Announcing our New Digital Banking

Now Live!

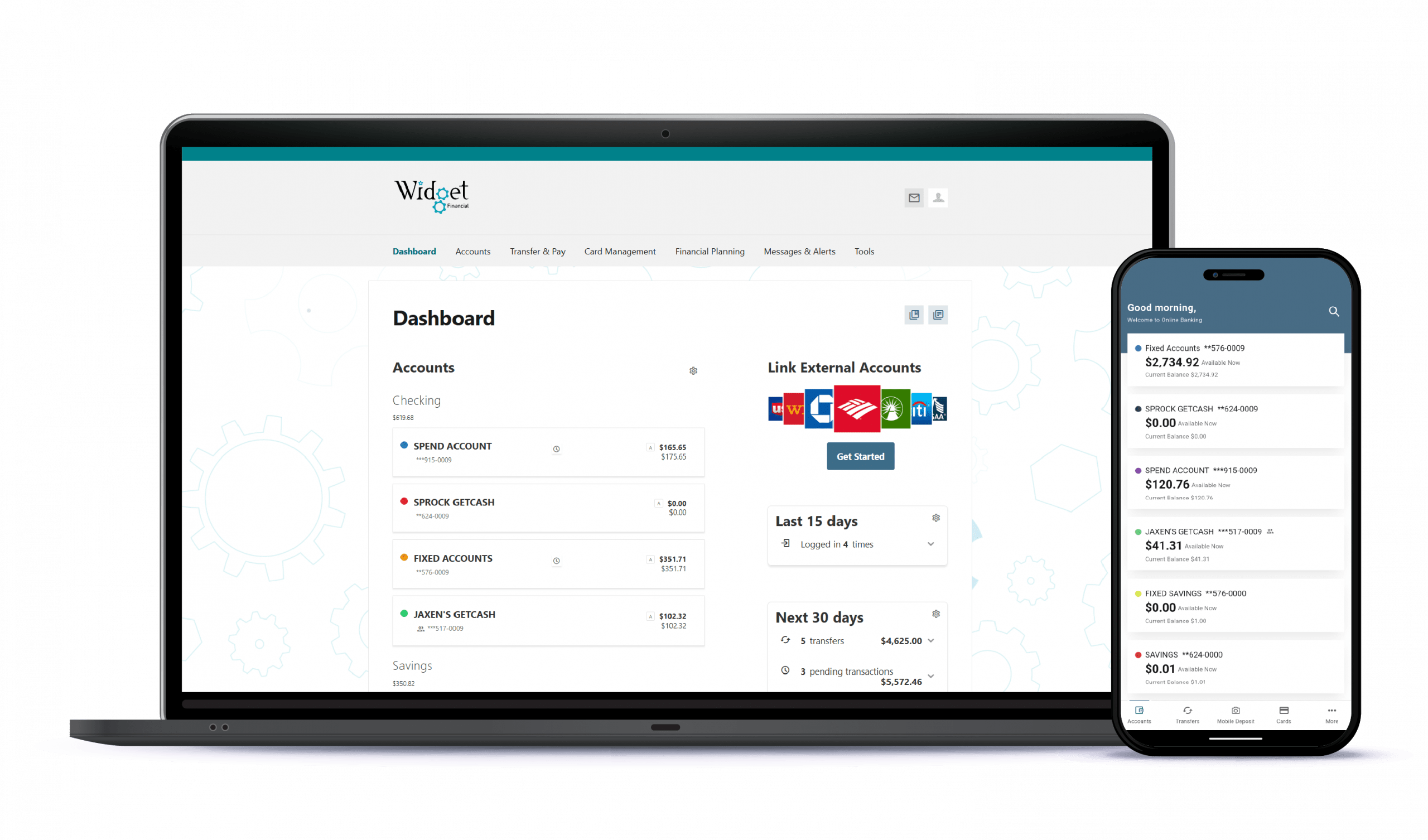

We’re thrilled to announce that Widget Financial’s new Digital Banking platform is now live!

Enjoy a fresh look, faster navigation, and new features designed to make managing your money easier than ever — including enhanced credit reporting, external account access, and stronger app security.

Please follow the steps below for your initial login to the new platform.

If you were not previously not currently enrolled, new registrations are paused until the new system goes live.

What Actions Are Required?

What you’ll need on your first login to Digital Banking

①

Use your current username and password to log in.

②

Please, have your SSN, date of birth, and ZIP code, and email or account number ready to verify your identity.

③

You’ll then set a new password and choose your security settings.

④

iPhone users, update your app. Android users, download the new Widget Financial app.

Widget Financial Mobile App

Exciting New Features

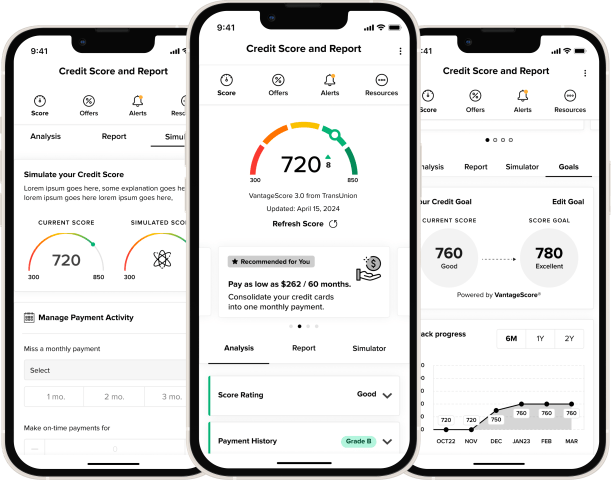

Credit Score Monitoring

Stay on Top of Your Credit

Your credit score plays a big role in your financial life—and now it’s easier than ever to track it inside your Widget Financial app. With our new Credit Score tool powered by SavvyMoney, you can:

- Check your score daily without affecting it

- See your full credit report anytime

- Receive instant alerts if something changes

It’s all free, built right into digital banking, and designed to give you confidence and peace of mind about your financial health.

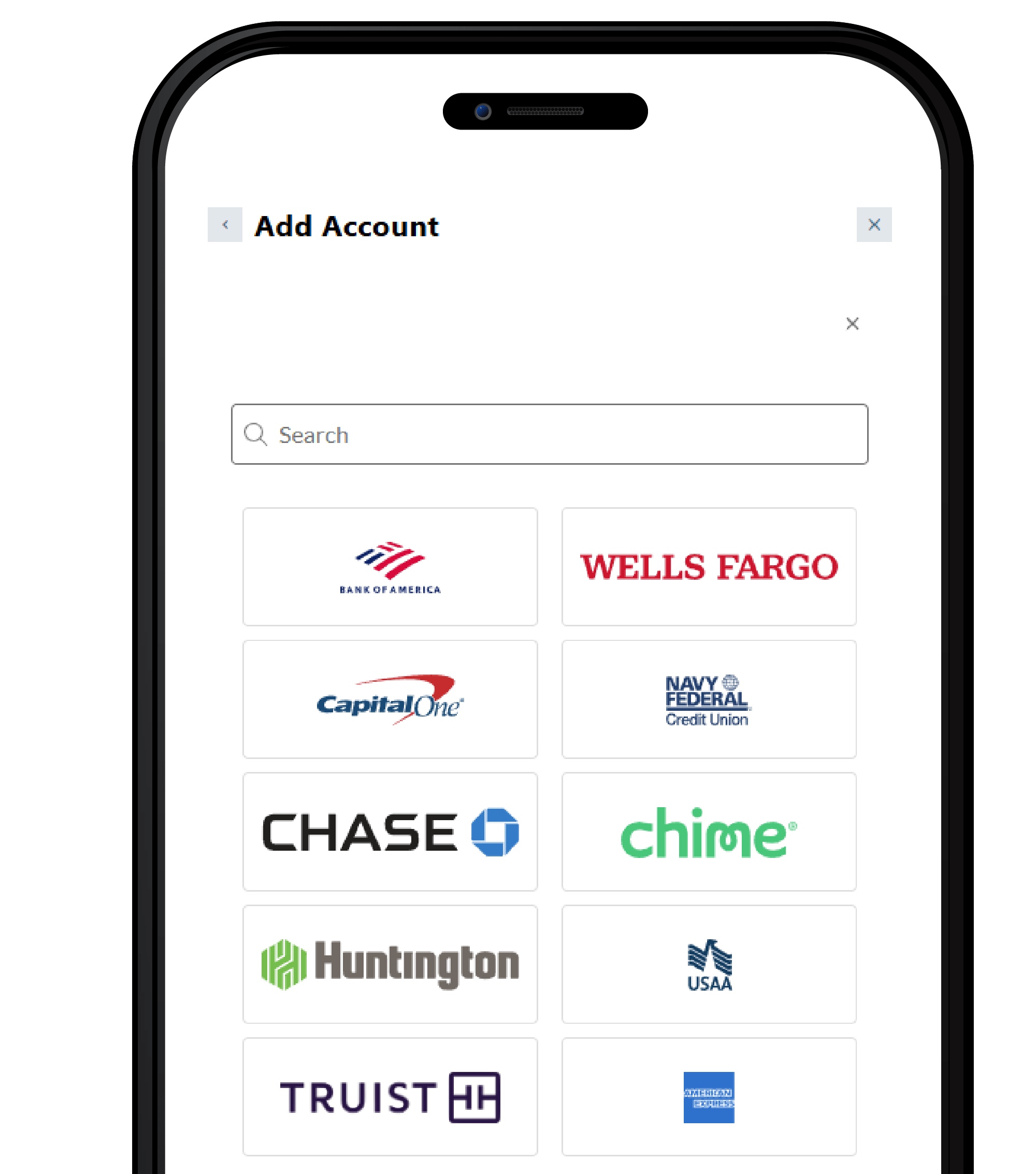

View External Accounts

All Your Accounts in One Place

Managing your finances shouldn’t mean juggling multiple logins. Our new platform lets you connect accounts from other banks, credit cards, or loans, so you can:

- See all balances together on one screen

- Track spending across multiple institutions

- Simplify budgeting with a single financial dashboard

- Stay organized with fewer logins and fewer apps to open

Bring everything together at Widget Financial and take control of your complete financial picture from one secure login.

Enhanced Bill Pay and Transfers

Simpler Payments, Faster Transfers

Paying bills and moving money shouldn’t be complicated. Our upgraded system makes it easier than ever to:

- Schedule, edit, or cancel bill payments quickly

- Set up recurring payments with just a few clicks

- Transfer funds between your Widget accounts instantly

- Send money to friends, family, or external accounts with ease

Whether it’s a quick transfer, a monthly payment, or paying someone back, the new tools give you more flexibility and speed—right from your phone or computer.