Credit Score Myths

(And What Actually Matters)

Credit advice is everywhere—and a lot of it is oversimplified. That’s why credit myths stick around. They sound reasonable, they spread fast, and they can lead people to make decisions that don’t actually help.

Let’s clear up a few common credit score myths and focus on the habits that matter most.

Myth: Checking your own credit score hurts it

In most cases, checking your own score is considered a “soft inquiry,” which does not impact your credit the way a lender inquiry might. Tracking your score is a healthy habit when it helps you stay informed and catch issues early.

Myth: Closing old cards is always good

Closing an account can sometimes reduce your available credit or affect the length of your credit history. That doesn’t mean you should never close a card, sometimes it’s the right move, but it’s worth thinking through, especially if the card has no annual fee and you’ve managed it responsibly.

Myth: Carrying a balance helps your score

You don’t need to carry a balance (and pay interest) to build credit. Paying on time is what matters. If you use a card, paying it down is typically the healthier long-term approach.

Myth: Income automatically improves your score

Your credit score generally reflects credit behavior, not income. Higher income can make it easier to manage payments, but it doesn’t directly raise a score.

What actually matters most

Credit scoring models vary, but most of them reward the same types of behavior: paying on time, keeping revolving balances reasonable, and being thoughtful about applying for new credit.

If you want one practical starting point, focus on two things: never miss a payment and avoid consistently high credit card balances.

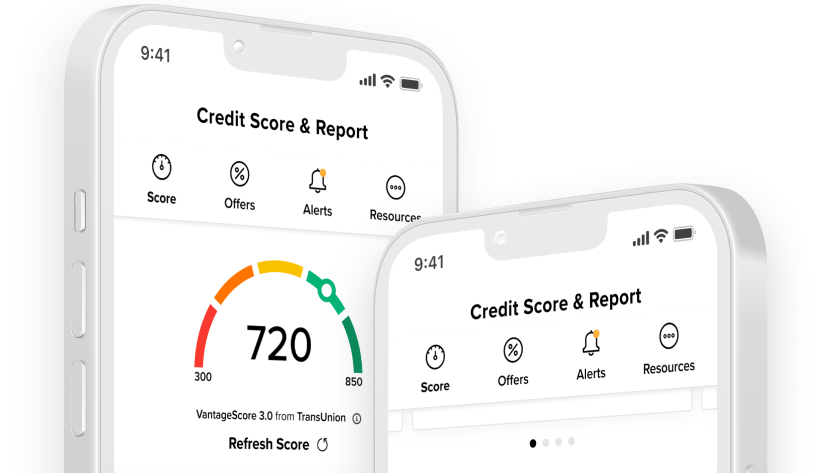

How SavvyMoney can help

SavvyMoney is a free tool for Widget Financial members, available in Digital Banking (mobile or desktop). It helps you track your score and see what’s influencing it so you can focus your effort where it counts.