How to Spot, Avoid and Report Fake Check Scams

In a fake check scam, someone that you don’t know asks you to deposit a check – most likely for a large amount of money, and usually for more than what you are owed – and send some of the money to another person. The scammer will always have a story as to why you can’t keep the money. They might say you will need to cover taxes and fees or buy supplies.

Fake checks come in many forms. The checks can come in the form of personal checks, cashier’s checks, money orders, or a check delivered electronically.

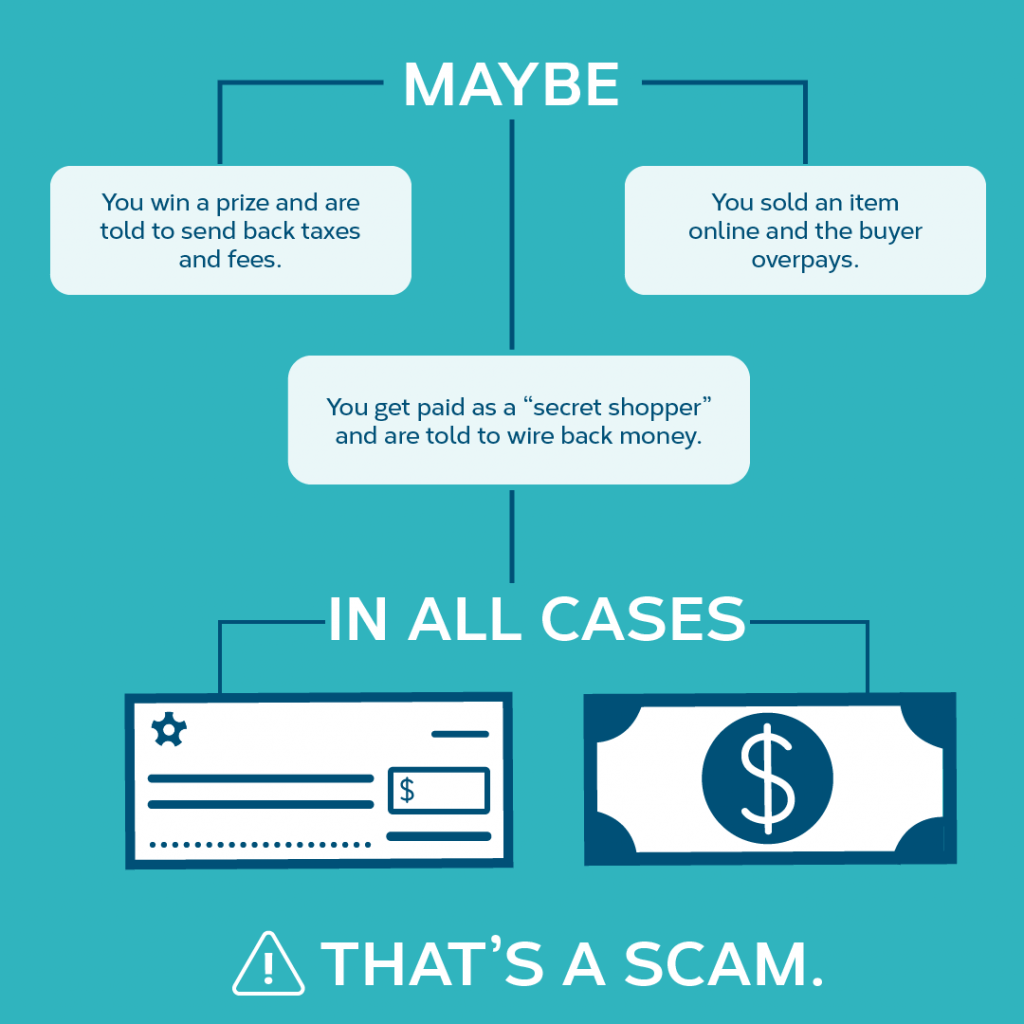

Types of Fake Checks Scams

There are many different types of checks scams. Here are some examples:

- Mystery Shopping.

- Personal assistants.

- Car wrap decals.

- Claiming prizes.

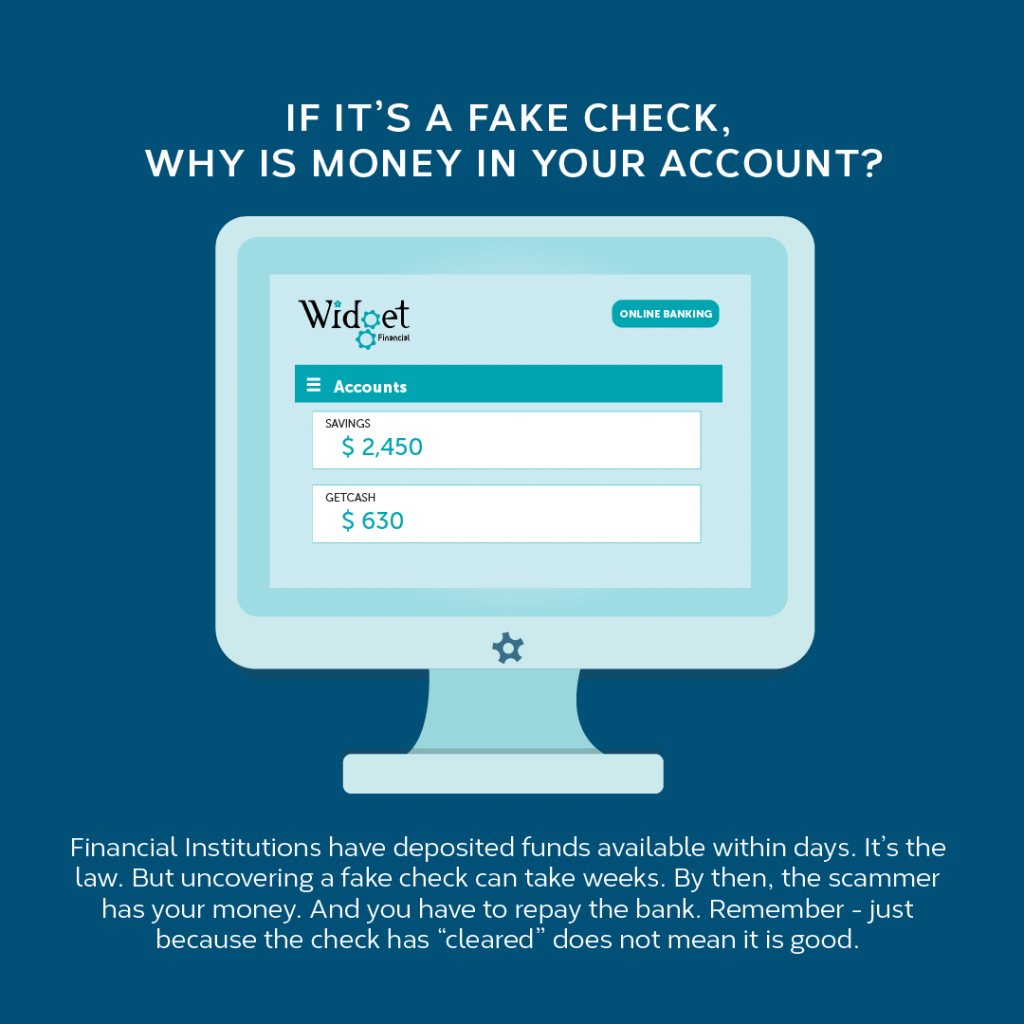

Why Do These Scams Work?

The scams work because fake checks generally look just like real checks, even to bank financial institution employees. The checks that the scammers use are often printed with the names and addresses of legitimate financial institutions. They may even be real checks that were written on bank accounts that belong to identity theft victims.

How to Avoid a Fake Check Scam

- Never use money from a check to send gift cards, money orders, or wire money to strangers or someone you just met. Once you wire money, or buy gift cards and send them the PIN, it is like giving someone cash. It’s almost impossible to get the money back.

- Toss offers that ask you to pay for a prize. When a prize is free, you should not have to pay for it.

- Don’t accept a check for more than the selling price. It is more than likely a scam.

What to Do If You Sent Money to a Scammer

Gift cards are never for payments. If someone demands payment by a gift card, they are most likely a scammer. If you paid a scammer with a gift card, tell the company that issued the card right away. When you contact the company, tell them that the gift card was used in a scam and ask if you can be refunded. Also be sure to tell the store where you bought the gift card as soon as possible.

If you have wired money to a scammer, call the money transfer company immediately to report the fraud and file a complaint. You can reach the complaint department of MoneyGram at 1-800-MONEYGRAM or Western Union at 1-800-325-6000. Ask for the money transfer to be reversed. It is unlikely to happen but it’s important to ask.

If you have paid a scammer with a money order, contact the company that issued the money order right away to see if you can stop payment. Another important thing to do is try to stop the delivery of the money order. If you sent the money order by U.S. mail, contact the U.S. Postal Inspection Service at 877-876-2455. Otherwise, contact whatever delivery service you used as soon as possible.

Where to Report Fraud

If you think you’ve been targeted by a fake check scam, report it to: